In a recent piece where I was cited1, The Economist wrote (emphasis added):

As solar panels and wind farms take over Europe, the question facing the continent’s policymakers is what to do with all the power they produce. Ultra-low—and indeed negative—prices suggest that it is not being put to good use at present, reflecting failures in both infrastructure and regulation.

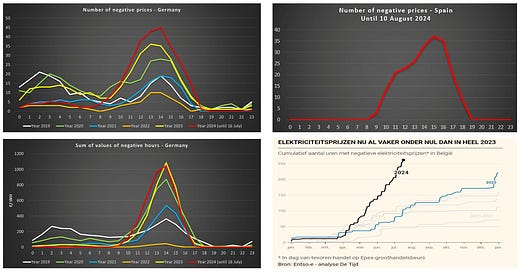

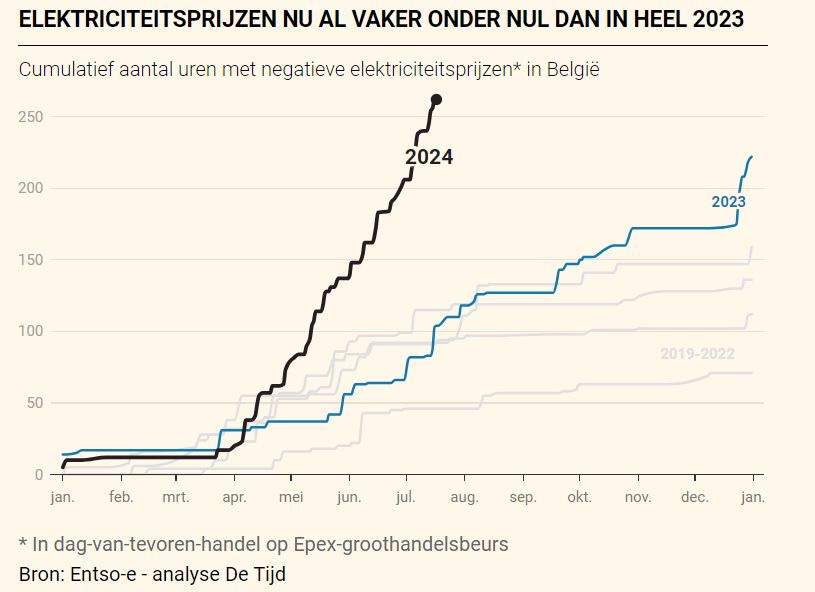

There is indeed a relatively sharp increase of ultra-low and even negative prices happening. This has been documented in numerous articles and posts2. For example, the Belgian newspaper De Tijd has published an article with this graph presenting the cumulative number of negative hours per year in Belgium. We can observe that 2024 is having much more negative hours than previous years.

At first glance, negative prices in the energy market might seem illogical. Why would anyone pay someone else to consume energy? Is energy ever something we need to dispose of, akin to waste?

Despite how puzzling it may seem, there are several factors driving these negative prices. In this post, I will explain the reasons behind negative prices, with a primary focus on the cornerstone of European electricity markets - the day-ahead market.

A look at negative prices: Germany

First, let’s look at the data for Germany, the largest bidding zone in Europe. We can observe that negative prices on the day-ahead market have already occurred in the past (see the years 2019 and 2020). Nevertheless, we can also observe that the year 2024 will without any doubt set new records both in terms of the total number of negative prices and the cumulative value of these negative prices. The first graph below presents the number of negative hours.

The second graph is the cumulative value of the negative hours3. Clearly, large negative values are driven by solar, which was much less the case in 2019 and 2020. In addition, overall energy prices were lower these years than currently and especially compared to the peak of the energy crisis (2022). Lower energy prices make it easier to get negative prices.

A look at negative prices: Spain

Unlike Germany, negative prices in Spain have only been observed this year. Furthermore, these prices significantly differ from those in Germany, as they tend to hover much closer to zero. In fact, the lowest negative value in Spain was -2 €/MWh. As shown in the graph below, occurrences of negative values are strongly correlated with solar generation.

Why are negative prices in Spain close to zero while they can be much lower in Germany? Why are there market actors willing to pay to produce electricity? Why can’t they simply switch off as it seems more economical?

Well, there can be various reasons4. Let’s explore.

Reason 1: It is impossible to reduce generation or to switch off

The first reason that some market actors are willing to sell electricity at a negative price is the impossibility for them of switching off or reducing generation. This inability to adjust output can manifest in several ways (non-exhaustive list):

Large Hydropower Plants: When reservoirs are full, these plants must continue generating electricity unless there is an adequate bypass system in place.

Run-of-River Hydropower Plants: These plants are sometimes not equipped to halt generation.

Small-Scale Solar Installations: Many rooftop solar systems are not designed to adjust their output based on external factors such as market prices. These systems are typically "install and forget" setups.

The lack of ability to reduce generation output is also tied to the absence of proper incentives. Without these incentives, there is no motivation to install the capability to modulate generation output. This lack of incentives is often related to the second reason for negative pricing.

Reasons 2: Revenues from subsidies and support schemes

Subsidies and support schemes are influencing the formation of market prices. There are different mechanisms in play:

A feed-in tariff or a net metering scheme is effectively decoupling generation from market prices. In a feed-in tariff, the producer will receive a constant amount for any kWh produced. It incentivizes the producer to maximal total generation, and not the maximal value. A net metering scheme has the same effect except that the rate of the feed-in tariffs is equal the consumption price (generally higher).

Green certificates, or any mechanism adding a constant remuneration on top of the market price, incentivize generators to produce until the price reached minus the value of the premium.

Some Contracts-for-Difference (CfD) continue the support even in case of negative prices. In general, more recent CfD are removing or limiting such clauses5.

Even though they all lead to negative prices, the impact of these support schemes are quite different. A constant FIT and net metering lead to must-sell bids and therefore, very large negative prices, while a constant feed-in premium, like the green certificates, should lead to only limited negative prices, depending on the value of the green certificates6.

Similarly, Guarantees of Origins (GO) work on a similar fashion as the green certificates, except that, in general, the remuneration of GO is much lower, leading to only limited negative prices (a few €/MWh).

Reason 3: Contract with a fixed remuneration

Similar to the previous reason, electricity providers are sometimes7 offering a fixed remuneration for any kWh injected into the distribution grid. Even if the injection tariff is low, there is no incentive to curtail generation, and therefore, people would be incentivized to keep generating.

The only difference is that a low injection tariff might have the long-term influence of incentivizing self-consumption patterns. Broadly speaking, net metering does not offer any incentive for self-consumption as the injection and consumption tariffs are the same. A sponsored feed-in tariffs like in Germany (around 80 €/MWh for a small solar installation8) represents a smaller incentive to self-consume compared to the injection tariffs from private suppliers (Belgium, around 20 to 40 €/MWh in July 2024).

Reason 4: Revenues from ancillary services

Ancillary services, also known as power reserves, provide additional financial opportunities for market participants. As highlighted in my previous posts (see for FCR and aFRR), the remuneration for these services tends to rise when traditional flexible assets are offline. For certain market players, the financial benefits of staying online and providing these ancillary services may outweigh the costs, making it a feasible strategy to compensate for any shortfalls.

Reason 5: Expensive to switch off

Certain power plants, such as specific nuclear and large thermal power plants, may incur substantial costs when switching off and restarting. Consequently, these facilities often remain operational even during periods of negative pricing, if the duration of such periods doesn't justify shutting down the plant.

As the electricity system evolves towards greater volatility, there is an ongoing effort to enhance the inherent flexibility of these traditionally inflexible assets. Alternatively, there's an interest in replacing them with more adaptable resources to better manage fluctuations in the power system.

Reason 6: Electricity is not the sole output

Certain power generation units are associated with other processes, like heat production in cogeneration plants. For these units, the decision to reduce or halt production isn't solely based on the value of the electricity produced. If there's a local need for heat, these plants will continue to generate electricity, even when the price is negative. Additionally, in some cases, electricity produced by cogeneration plants may receive additional compensation through support schemes, providing another incentive to maintain production.

Not only does electricity face negative prices

Negative prices are not unique to electricity, even though, due to its nature, electricity markets seem to be impacted more than other commodities. Nevertheless, there have been examples with negative prices in other commodities such as natural gas.

U.S. spot natural gas prices in Texas on Tuesday fell below zero for the first time since May as pipe maintenance trapped gas in the Permian Shale even as demand for the fuel soars as consumers crank up their air conditioners to escape a brutal heat wave.

Probably even more surprising was the negative price of oil during the Covid-19 pandemic.

The logic is similar: when the supply is too abundant compared to the demand and there is no possibility to store, the price of the commodity is turning negative, meaning that the commodity is somehow an undesirable product.

What is next for negative prices?

Many are questioning whether we will see an increase or decrease in negative electricity prices in the coming years. In my view, this will largely depend on the progression of several key factors:

Additional Renewable Capacity: What volume of new capacity will be added?

Support Schemes for Additional Capacity: What will the support schemes for this new capacity look like?

Adoption of Electric Vehicles and Energy Storage: How widely will these be adopted?

Demand Flexibility: To what extent will demand-side management be implemented and how effective will it be?

Electricity Demand: What will be the growth rate of electricity demand, particularly with new uses such as data centers and hydrogen production?

Adaptation of the Current Electricity Mix: How will the existing mix of energy sources adapt?

Increase in Interconnections: How will the interconnectivity of power grids evolve?

Other Factors.

Given these variables, making an accurate long-term forecast is challenging. However, for the short term (up until 2027), I predict an increase in the occurrence of negative prices from the present 2024 level. This is primarily due to the still rising installation rate of solar power, while the support schemes for solar have yet to fully adapt to limit negative pricing instances and other factors (electric vehicles, storage, demand flexibility) are not yet scaled enough to compensate the rise of solar. Beyond this period, we might have a different technological environment with increased flexibility, resulting in a limitation of the number of negative prices.

It was a nice surprise for me. The citation is: In May the “capture rate” of German solar panels—the share of the average daily energy price that they earned—dropped to 50%, down from 80% three years earlier, according to calculations by Julien Jomaux, an energy consultant.

The sum of the values of all negative hours.

The list is probably not exhaustive. Do not hesitate to add yours in comment. In addition, some reasons are interlinked.

As soon as the sum of the feed-in premium and the market price is below its marginal cost, generally close to 0, the generator is incentivized to stop generating.

Great Julien

Generally, renewables are easy to switch off and should not stay on when prices go negative. Regulated tariffs that do not cater for negative prices should be the rule (and they are, mostly, for new installations, at least the large scale kind)