More details on negative prices

The impact on support schemes and the distinction between small and large negative prices

In a previous post, I discussed the reasons behind negative prices, offering a fairly comprehensive list, though likely not exhaustive. One important element I overlooked is the distinction between small and large negative prices, which I believe plays a crucial role. In this brief post, I aim to address this gap by providing further analysis, focusing on the impact of support schemes for solar energy.

Why negative prices are important

Negative electricity prices have been a hot topic, as seen in recent articles from renowned journals1. This attention is understandable, given how counterintuitive it seems that something as essential as electricity could be free—or even more puzzling, that consumers could be paid to use it. However, what may seem strange to a newcomer is quite logical for those familiar with commodity markets: since electricity is difficult (and costly) to store, oversupply can lead to a price collapse, even pushing prices into negative territory.

The graph below shows the amount of renewable energy produced during periods of negative pricing. In 2020, there was a relatively high share of generation at negative prices, which is not surprising given the significant price drops during the COVID-19 pandemic. In contrast, this share was almost nonexistent in 2022, the peak of the energy crisis. In 2024, however, we see a sharp increase in this share of solar energy, highlighting its unique dynamics.

As of 2024, over 20% of solar MWh was generated during hours with negative prices. This figure refers solely to the energy actually produced, excluding any potential output lost due to technical or economic curtailment2. The high percentage underscores that solar is already 'saturating' the market to some extent.

This trend has significant implications, particularly for projects supported by government schemes, such as Contracts-for-Differences (CfDs). Many such contracts now include clauses that suspend payments during periods of negative prices. For instance, under Germany’s EEG law, payments will be halted for all hours with negative prices from 20273. In practical terms, if 20% of your production receives no support, the bankable portion of your generation decreases. This would lead to higher costs per supported energy produced, meaning higher strike prices4 to compensate for the shortfall.

-1 or +1 €/MWh, does it matter?

The suspension of support during periods of negative prices creates an important threshold. However, if renewable operators were fully exposed to market price risk, is there really a significant difference between -1 €/MWh and +1 €/MWh? In fact, as I’ve discussed in this post, a renewable producer could even potentially be interested in bidding above 0 €/MWh to maintain an upward margin and benefit from offering upward flexibility.

For fully merchant projects, the 0 €/MWh threshold is less relevant. What truly matters are the instances of significantly negative prices

Large negative prices

Day-ahead prices can go as low as -500 €/MWh, the minimal authorized price, a threshold reached on July 2nd of last year. On that day, the cumulative negative value was -1,653 €. In 2024, we haven’t seen such extreme lows5—the minimum price on the German market has been -135 €/MWh. However, the total cumulative value of negative prices is higher this year (-5,158 € as of September 21) compared to 2023 (-3,873 €/MWh).

If your assets are exposed to market prices, larger negative prices should be sufficient to incentivize you to curb your production6. If large negative prices happen, it means that there is a significant share of assets that do not react to market prices.

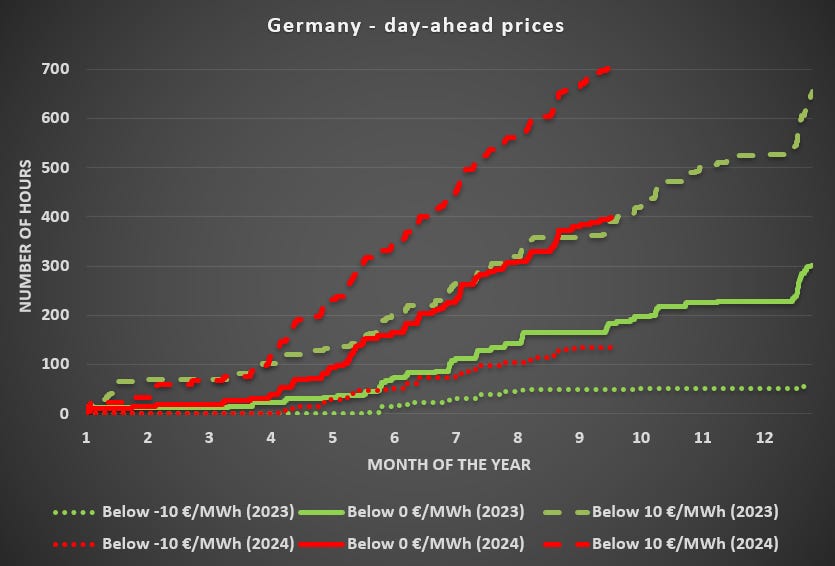

Below, I present the number of hours in three price categories: below 10 €/MWh, below 0 €, and below -10 €/MWh, for 2023 (green) and 2024 (red).

The graph shows that, as of the end of September, the number of hours with negative prices in 2024 is roughly the same as the number of hours with prices below 10 €/MWh in 2023, both around 400 hours. Interestingly, the number of hours with significantly negative prices (below -10 €/MWh) is much higher in 2024 compared to last year. By the end of 2023, there were only 56 hours recorded with prices below -10 €/MWh, whereas by September 21, 2024, this figure had already reached 135 hours7.

(Distributed) solar, the source of large negative prices

Negative prices, particularly large negative ones, do not occur randomly. The chart below shows the occurrence of prices below -10 €/MWh and 0 €/MWh by hour during the 'solar season' (April to August) for 2023 and 2024. The trend is striking: most negative price hours, and all instances of significantly negative prices, coincide with peak solar generation hours.

One of the key factors contributing to this issue is the lack of response from small-scale solar installations. A significant portion of new solar capacity in Germany comes from residential systems. Under the EEG law, installations up to 100 kW are guaranteed a fixed feed-in tariff (FIT) for 20 years. The tariff rates vary by system size (under 10 kW, under 40 kW, and under 100 kW) and whether the system is used for self-consumption or full feed-in8.

Below are the approved FIT rates for residential solar systems (under 10 kW), either for full feed-in or partial feed-in (the latter is more common with self-consumption). The tariffs are above 120 €/MWh for full feed-in and over 80 €/MWh for partial feed-in. In yellow, the market value for solar is shown, which, as we can see, is significantly lower than the guaranteed FIT.

According to this article, ground-mounted solar represented 29% of the new installations at the start of 2024, which means that most probably more than two-thirds of new solar capacity installed in Germany has been with a fixed FIT, where we should not expect a reaction based on market prices. Moreover, the article specifies that 28 GW is now open-space solar, which is about a third of all solar only. The major part of the remaining solar is likely inflexible small-scale solar.

What’s next?

As we can see, negative prices—especially larger ones—are becoming more frequent. My perspective is as follows:

The rise of negative prices poses a risk to renewable projects under support schemes that suspend payments during periods of negative pricing. The loss of supported generation could result in the need for higher strike prices to compensate.

Large negative prices shouldn’t occur in a system where renewables respond effectively to market signals. It's crucial to ensure that small-scale solar installations are better managed to help prevent large negative price spikes, especially as solar capacity continues to grow. Support schemes like Germany’s fixed 20-year feed-in tariff, which adds several gigawatts of inflexible power each year, need to be reformed to introduce more flexibility.

Flexibility solutions—such as batteries, electric vehicles, and demand response—are essential to integrating more renewable energy. However, addressing the root causes of inflexibility, including rigid support schemes for renewables, is just as important. Adding a home battery would help but it would help much more if the complete system (solar and battery) is being driven by incentives that support the system. Such a system subject to a fixed FIT would not care about the afternoon energy surplus when the battery is full for example.

Thank you for reading! Feel free to share this with your friends and colleagues.

Julien

See the Financial Times or this report from Timera Energy.

This might be a reason why the share for wind is lower as economic curtailment happens more for wind, especially offshore wind (but not the only one, as negative prices happen more during solar hours).

The calendar is progressive until 2027: in 2023 for at least four consecutive hours with negative price, in 2024 and 2025 for at least three consecutive hours, in 2026 for at least two consecutive hours, and from 2027 for at least one hour, the support is reduced to zero for the entire period during which the spot market price is continuously negative.

Maybe the market is better prepared to react on such large negative events.

For very small negative prices, investing time and resources to halt generation might not yield enough return, especially for small assets.

It is unlikely that the number will still grow much as we enter the end of the solar season.

Remuneration for full feed-in is higher because self-consumption is being remunerated higher for the part that is self-consumed (retail tariffs are higher).

Just a suggestion, as this part is a bit confusing: "The graph shows that, as of the end of September 2024, the number of hours with negative prices is roughly the same as the number of hours with prices below 10 €/MWh, both around 400 hours."

It should read "The graph shows that, as of the end of September 2024, the number of hours with negative prices in 2024 is roughly the same as the number of hours with prices below 10 €/MWh in 2023, both around 400 hours."

Empirically, there is little to argue with. Problems start with the narrative/analysis at the end. Negative prices occur because renewables (CAPEX-based) are forced into a marginal market which suits OPEX-based systems. Marginal markets are treated in a quasi-religious way ("our market which art in heaven" etc) instead of an objective way. To some extent, this is understandable if you are a trader & rely on market volatility to make money - at all costs you want to keep markeginal markets going - regardless of their suitability or lack thereof for CAPEX-based system. However, a failure to recognise this reality, leads to a situation where the assumption is that modest changes to marginal markets can fix the situation. The other failure in the analysis is that as the amount of renewable increases - so do surpluses - in a non-linear fashion. This is not an assertion but can be proved - for just about any size of system (regional or national). In terms of the solutions offered - not attempt is made to consider scalability. For example, which systems at a national level (or local level) offer the possibility to store 200GWh - 500GWh of electicity (national) or 3MWh (locally). If Germany hits some of its targets for RES, these are the sort of national surpluses it will face post 2030. Batteries have a minor role to play - electrolysers have a major role. The problem is that on the one hand RES only gets funded if the flow of revenue is certain, on the other hand it is proposed to use "market mechanisms" (we will incentivse things) to pull on RES. Remind me how well market mechs have worked so far? Well they haven't because they can't. Energy transformations are engineered (horse) - markets are then used for cost optimisation purposes (cart) - once the transition is made. Currently we have the cart (markets) standing in front of the horse (engineered transition) and we are wondering why nothing is happening.