Solar and the need for more flexibility

Some examples showing the increased need for flexibility when the sun is shining

Solar energy is experiencing a rapid global surge and is poised to become a cornerstone of our future energy grids. This exponential growth can be attributed to several key factors: remarkable cost reductions, a concerted global push towards emission reduction, and the inherent scalability of solar technology, facilitating rapid deployment.

As solar's influence expands, its impact on various facets of the electricity sector becomes increasingly apparent. In this discussion, we will discuss several topics concerning the heightened demand for flexibility and its ramifications within European electricity markets. Specifically, we'll explore four key illustrations: the proliferation of low prices on day-ahead markets, the repercussions of solar overproduction on intraday and balancing markets, the escalating value of flexible assets, and the augmented capacity prices of power reserves during sunny hours. While our aim is not to provide an exhaustive analysis, these examples offer insights into the profound impact of solar energy on our electricity markets.

Calling for more flexibility

Before exploring our examples, it's essential to underscore a prevailing trend: there are calls for more flexibility coming from all sides. As we transition towards a renewable-centric electricity system, particularly driven by solar and wind energy, stakeholders throughout the electricity sector acknowledge the necessity to increase the system flexibility and especially, enable demand response.

Flexibility, unlike energy or power, is more a general notion than a physical value with a proper unit attached to it. Indeed, flexibility spans both generation and consumption, with storage serving as a versatile intermediary. Furthermore, flexibility can take structured forms, responding to signals sent by system operators or the grid frequency, or unstructured approaches, reacting to price signals.

The concept of flexibility encompasses a wide array of considerations. In this post, we're spotlighting four examples that underscore the heightened demand for flexibility, especially evident in systems where solar energy predominates.

Example 1: the sharp increase in very low prices

The first example is the increase of low prices on the day-ahead markets. The graphs hereunder present the number of hours with prices below 5 /MWh for Spain and Greece1. We can observe that the year 2024 (in red) is relatively exceptional compared to the previous years, even though the year 2023 had already experienced an increased number of low prices. The situation in Spain has been exceptional as described in this recent post.

Example 2: oversupply on a sunny afternoon

On Sunday, May 12th, an abundant supply of solar energy coincided with low demand across Europe, due to favorable weather conditions and the usual lower demand on Sundays. Consequently, this alignment precipitated exceptionally low negative prices on the day-ahead market, plummeting to as low as -200 €/MWh in the Netherlands by 1 PM.

Moreover, real-time solar production has exceeded expectations, resulting in an oversupply of solar energy throughout the day. Below is the difference between the latest forecast updates and the actual solar generation in Belgium.

The combination of robust solar production and a conservative forecast led to interesting dynamics in the intraday and balancing markets. With solar energy dominating the supply mix, there's limited space for flexible assets to adjust their generation, including reducing production. As actual solar output surpassed initial predictions, market players sought to offload surplus energy, intensifying pressure on the intraday market. By 2 PM, the weighted average of intraday trades in Germany hit -539 €/MWh, with the lowest deal plunging to -2745 €/MWh.

Market participants are willing to accept such steep negative prices to evade imbalance charges. In both Belgium and Germany, imbalance prices plummeted into highly negative territory during the afternoon.

The graph below illustrates the system imbalance in Belgium (depicted by orange bars) alongside the corresponding imbalance prices. There was a significant surplus of energy during the afternoon, coinciding with hours of negative imbalance prices.

In Germany, imbalance prices reached the bottom-low level with one quarter-hour reaching -2337 €/MWh2.

Imbalance prices represent the costs borne by transmission operators to ensure system equilibrium, essentially reflecting the price of mobilizing reserves. The occurrence of these low-price events is further exacerbated by the escalating activation costs of reserves when system flexibility is constrained, as I detailed in a previous post here.

Example 3: increased capture price of flexible assets

In previous posts3, I've extensively emphasized the diminishing capture rate of solar energy with its increasing penetration. Conversely, it's interesting to examine the capture rates of flexible assets. Among these, hydro-pumped storage stands out as the most flexible asset, as these assets can store surplus energy when it's abundant and discharge it when demand peaks.

Below are the capture rates for various technologies over the last 15 months in Greece. It's evident that hydro, including reservoir-based hydro, boasts significantly higher capture rates compared to other technologies, notably solar. Plotting a scatter chart of solar capture rates against those of hydro-pumped storage reveals an inverse linear relationship, underscoring the growing value of flexible assets.

Example 4: aFRR capacity price in Germany

Beyond the energy markets such as the day-ahead and intraday markets, the capacity price for power reserves is also deeply impacted by solar. Transmission System Operators are securing reserves to maintain the grid balance by procuring the capacity of various reserves4 on a regular basis.

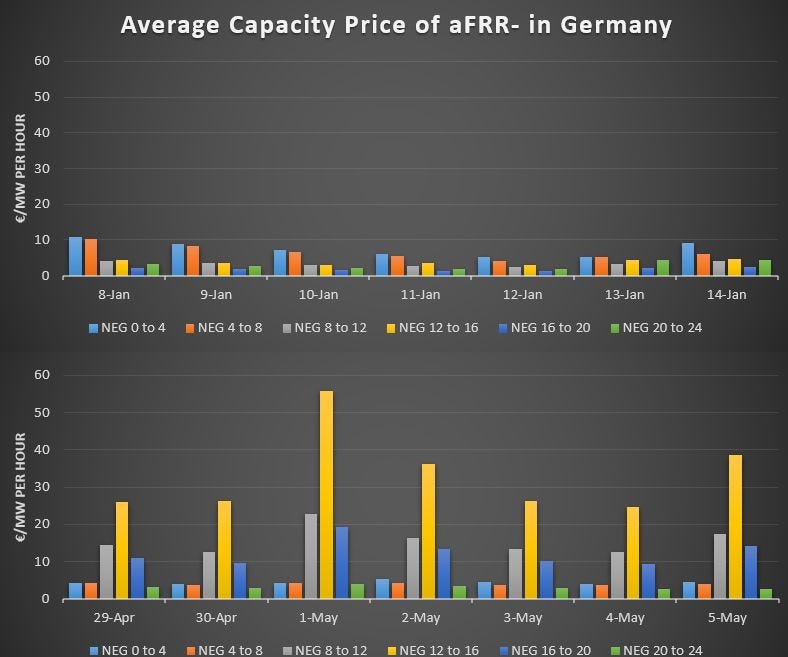

Hereunder, the capacity prices5 of aFRR- (or downward aFRR, i.e. reducing generation / increasing consumption) for a winter week (8 January) and for a spring week (29 April) are presented.

aFRR downward is procured by 6 blocks of 4 hours every day. The difference between the sunny hours of last week and the other blocks is important. Indeed, the block 12 - 16 was between 25 and 55 €/MW per hour last week while it was always lower than 11 €/MW per hour for all blocks in the winter week and below 5 €/MW per hour for the night blocks of last week.

These capacity prices underscore a crucial point: the cost of flexibility, as exemplified by the capacity price of aFRR-, escalates notably when the sun is shining. This trend becomes particularly pronounced on days characterized by low demand, such as the first of May6, when solar energy assumes a more prominent role in the energy mix.

In conclusion

Solar power is experiencing a dramatic surge, and the electricity sector must adapt accordingly. From managing the absence of solar generation at night to potentially grappling with oversupply at midday, the system faces significant challenges. One of the most prominent impacts is the heightened demand for flexibility, reverberating throughout various facets of the electricity sector, including the emergence of low prices on energy markets, the escalating value of flexible assets, and the uptick in reserve prices when inherent system flexibility is limited.

However, solutions do exist. Among the available options are batteries. With numerous large-scale projects on the horizon, batteries promise to significantly enhance the available flexibility within our systems. Another promising avenue is leveraging demand flexibility, particularly with assets boasting substantial potential, such as electric vehicles. Yet, despite these solutions, challenges remain, making this a great time to be engaged in the sector.

Please note that the Y-axis is not similar.

Imbalance prices in Germany and Belgium present dynamics that are quite different. Imbalance prices in Belgium are generally more volatile than in Germany but are limited to +- 1000 €/MWh while Germany allows more extreme imbalance prices.

There exist different reserves in continental Europe, most notably FCR, aFRR, and mFRR (previously called primary, secondary, and tertiary reserves). Differences exist between the various countries, even though there are ongoing efforts to harmonize these products on the European level.

The capacity prices are expressed in €/MW per hour. It is a price paid for 1 MW of the procured reserve for one hour. It should not be confounded with €/MWh, a price paid for energy.

The 1st of May is a national public holiday in many European countries.

The excessive negative prices are a symptom of a broken electricity market design. Renewables in Germany are paid fixed prices for their produced electricity, guaranteed by the government. If the electricity can't be handled by the grid, they are compensated anyway.

This system incentivizes several kinds of bad behaviour, such as

1) Renewables overproducing, forcing everyone else to deal with the consequences instead of curtailing the the sources which can do this the easiest and are responsible for the problem.

2) Not caring about installing renewable generation capacity that is producing as uncorrelated as possible to the rest of the renewables.

3) Installing new renewables generation even if the grid hasn't been expanded enough yet to handle the random load peaks of renewables.

All in all, a very questionable market design once renewables penetration rises. And one that is going to cost the state a lot of money (already 10-20 Billions a year in Germany). And yet the SocDems and Greens complain about not having enough money for further subsidy programs to make expensive renewables technologies competitive. Of which we will need a lot to incentivize the overbuild and the expensive hydrogen backup required because nuclear is considered sinful for almost religious reasons.

I don't really understand the negative price phenomenon. Is it producers who must pay the negative price? If so, why not simply disconnect the generation? It would seem to be more economical than paying to generate.

Or is it transmission system operators who pay the negative prices? If so, why can't they disconnect excess supply, rather than pay someone else to absorb unneeded supply? Are there legal requirements that all renewable electricity must be used and paid for? This seems like a foolish requirement.